Weekly Summary: Focus On Web3 Venture Funding as TVM Ventures Launches $100M Fund

In this edition, Web3 venture funding takes centre stage as TVM Ventures launches with $100M for TON-based projects and OG Foundation launches $88M fund for AI-powered DeFi projects.

💵Crypto VCs Double-Down on Startup Funding

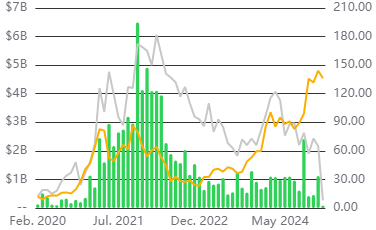

Web3 venture funding this year got up to a fast start with crypto startups raising $1.2 billion in January, a 147% rise from the previous month, according to data tracked by the AI-powered crypto analytics platform SoSoValue.

Overall, there were 65 rounds, a nearly 11% decline from December. The average amount raised per round was 17.25 million, an increase of 177% compared to the previous month.

Some of the big highlights in the fundraisings during the month included Helio’s $175 million Acquisition by MoonPay, Alterya’s $150 million acquisition by Chainalysis and Phantom's $150 million Series B.

At this rate, Web3 venture funding is tracking to deliver the best quarter since April 2022, and the latest Web3 venture backing supports that after TVM Ventures launched with $100M and 0G Foundation launched a $88 million fund, while Bitcoin Ordinals project Taproot Wizards raised $30 million for OP-CAT ecosystem.

TVM Ventures Launches with $100M Fund Focused on TON-Based Projects

Launched by TON Foundation member Steve Yun, the fund is backed by Yun himself and a Toncoin miner.

The fund will back startups building on the TON ecosystem, especially DeFI and PayFi projects.

It targets early-stage startups valued at $5 million to $10 million as it aims to take the lead position with checks of $500,000 to $1 million.

“Regarding DeFi, it will be imperative to build natively on TON, including the smart contract logic written on TVM directly,” Yun said, adding “PayFi is cross-chain by nature and therefore more flexible, but 100% must support the TON network.”

0G Foundation Launches $88M Fund to Back the Next Generation AI-Powered DeFi Agents

The fund is backed by leading Web3 VCs including Hack VC, Delphi Ventures, Bankless Ventures and OKX Ventures.

The announcement comes ahead of the company’s anticipated mainnet launch of its AI-focused blockchain in the first or second quarter of 2025.

“The rapid growth of AI capabilities, coupled with the need for trustless, transparent systems in finance, makes this the ideal time to accelerate the development of autonomous agents,” Michael Heinrich, co-founder and CEO of 0G Labs

Bitcoin Ordinals Project Taproot Wizards Announces $30M Funding for OP_CAT Ecosystem

Standard Crypto led the round Standard Crypto, with participation from Cyber Fund, Collider Ventures, Geometry, Masterkey VC, and Newman Capital.

The company plans to use the funds to expand the OP_CAT functionality on Bitcoin.

OP_CAT is a short form for OPcode Concatenate or OP_CONCAT, which Wertheimer describes as simple scripting for Bitcoin to enable automated and customisable transactions.

“The cool thing about OPCAT, because it’s so flexible,” co-founder Udi Wertheimer said. “What I expect is that people are going to create tons of new protocols. Instead of having Ordinels and BRC20s, once per quarter, a new protocol like that shows up like the heydays of Ethereum or Solana, where people create new protocols on a daily basis.”

Union Square Ventures Leads $14M Series A for Token Trading Infrastructure Reservoir

The fundraising also attracted participation from Coinbase Ventures, Variant, Archetype, 1kx and others.

The company plans to use the fresh capital to expand beyond NFTs and enable token trading on apps across multiple blockchains.

“We’re moving towards a world with millions of tokens issued across thousands of chains,” Reservoir co-founder and CEO Peter Watts said. “Reservoir’s mission is to enable seamless movement between all of these assets, to unlock powerful new use cases across finance and culture.”

DePIN Project Beamable Secures $13.5M Series A Round Led by Bitkraft

Arca, Advancit Capital, P2 Ventures, Solana Foundation, Scytale Digital, GrandBanks Capital, Permit Ventures, and others participated in the fundraising.

The company plans to use the fresh capital to support the development of its decentralised gaming infrastructure.

It is building Beamable Network, which seeks to reduce the reliance on centralised hyperscalers.

Beamable uses tokenised incentives to align contributors and users, creating a community-driven infrastructure.

“BITKRAFT has been a leader in identifying transformative opportunities at the intersection of gaming and Web3, and this funding validates the enormous potential of the Beamable Network to revolutionize videogame infrastructure,” said Jon Radoff, CEO and Co-Founder of Beamable. “By leveraging the proven success of our existing platform and integrating decentralized principles, we’re unlocking a new era of scalability and inclusivity for developers.”

🎮Blockchain Gaming

UAE-Based The Game Company Raises $10M for Its Cloud-Based Web3 Gaming Platform

The company leverages its “low-latency proprietary tech” to enable “lag-free” gameplay on PC, consoles and other devices.

The latest fundraising was led by Telcoin and its CEO Paul Neuner, BullPerks and Singularity DAO.

The company claims to have already onboarded 500,000 waitlisted users for its upcoming cloud-gaming platform.

The Game Company CEO and co-founder Osman Masuds said in a statement: “Most of the new capital will be used to enhance the platform and its integration within web3 as well as web2 ecosystems, hoping to take on legacy cloud-gaming with a twist of blockchain.”

Telegram-Based GOAT Gaming Secures $4M Strategic Round from TON Ventures and Others

The fundraising also attracted participation from Karatage, Amber, and Bitscale.

The fundraising brings the total raised to $15 million GOAT said in a press release shared with NFTgators.

The web3 gaming project plans to use the capital to integrate autonomous agents for AI-driven gaming experiences.

Simon Davis, CEO of GOAT Gaming said in a statement: “We believe that Telegram is the most accessible gateway to Web3 and GOAT Gaming is on the way to hosting hundreds of games, integrating countless autonomous agents, and delivering a seamless, AI-driven gaming experience.”

🔊More News

Ondo Finance Launches Ondo Chain to Bring Institutional-Grade Financial Markets OnChain

Asset management firms Franklin Templeton, Wellington Management and WisdomTree are advising on the design of the layer-1 blockchain.

The announcement follows Tuesday’s launch of Ondo Global Markets designed to bring stocks, bonds and ETFs onchain.

The company will use permissioned validators to verify transactions and ensure accurate, up-to-date data.

CEO Nathan Allman said: “Ondo Chain is designed to meet the highest institutional standards while remaining open for developers and innovators. It tightly couples on-chain and off-chain infrastructure, reducing cost, enhancing security, and ultimately enabling a better user experience.”

Bitrue Announces Support for Berachain Ahead of BERA Token Listing

The announcement also coincides with Berachain’s token generation event.

Berachain is building an EVM-identical Layer 1 blockchain to compete with Ethereum and Solana.

Adam O’Neill, Chief Marketing Officer at Bitrue said in a statement: “Investors are demanding exposure to exciting new projects as early as possible in order to lock in prices before coins go mainstream, so at Bitrue we’re proud to offer day-1 support for a highly anticipated coin like BERA to our users.”

📈On-Chain Analysis

Royco Skyrockets to $3B TVL Ahead of Berachain Launch

Royco Protocol has surged to $3 billion in TVL, becoming one of DeFi’s fastest-growing platforms ahead of Berachain’s highly anticipated launch.

The protocol positions itself as a platform for creating Incentivized Action Markets (IAMs).

In IAMs, incentive providers offer tokens or points for ‘Action Providers’ to perform on-chain actions, such as depositing crypto funds into a certain protocol, minting a non-fungible token (NFT), or executing certain transactions.

Stay on top of things:

Subscribe to our newsletter using this link – we won’t spam!