Weekly Summary: Focus on Digital IP as Story Protocol Secures $80M, Crypto’s ‘EnGulfing’ Opportunity and Web3 AI

The “world’s IP blockchain” Story Protocol boasts $140 million in total funding, while Gate Ventures and Tether eye crypto opportunity at the Gulf and Fetch.ai launches innovation lab for AI startups.

VCs Back Story Protocol’s Bid to Disrupt Digital IP

The “world’s IP blockchain” raised $80 million in a Series B round led by Andreessen Horowitz’s digital asset investment arm “A16z Crypto” with participation from Polychain Capital, alongside notable angel investors.

The Series B round brings the total raised by Story Protocol to date to $140 million, following a $54 million raised last year, which A16z crypto also led. The Web3 company is also backed by the likes of Hashed, Samsung Next, Paris Hilton’s 11:11 Media, Dao5, and Eva Lau’s Two Small Fish Ventures.

Why it matters

The team behind Story Protocol sees IP as an asset class beyond Hollywood, Music, Literature and Billboard charts. “IP means training data, AI models, memes, UGC videos, game assets, character traits, and so much more.”

The company offers a Proof-of-Creativity protocol that enables permissionless licensing and automated royalty payments. This allows for easy sharing of IP rights that unlock new revenue streams for creators.

The company says more than 200 teams with over 20 million addressable IPs are already building on Story Protocol.

Chris Dixon, founder and managing partner at A16z Crypto commented: “PIP Labs is building the necessary infrastructure for a new covenant in the AI age. Blockchains are perfectly suited for large-scale economic coordination, and Story’s platform ensures creators are compensated for their IP feeding the AI systems.”

The BIG picture

The rapid growth of artificial intelligence has magnified the opportunity for digital intellectual property, handing individuals and teams the platform they need to easily create studio-quality IP.

However, as Story Protocol points out, the current economic model that governs what it calls a “multi-trillion dollar IP asset class” only benefits a few, big tech and LLMs.

“Big tech is stealing IP without consent and capturing all the profit. “First, they will gobble up your IP for their AI models without any compensation back. Then, they will hijack your future economics by sucking in all your potential traffic,” S.Y Lee, co-founder and CEO of PIP Labs, the company behind Story Protocol said in a statement.

The AI market is forecasted to experience exponential growth over the next six years, reaching a valuation of more than $800 billion according to Statista, from about $184 billion in 2024.

Story Protocol’s IP-centric layer-1 blockchain wants to tokenise intellectual property, making programmable IP in the era of AI. It allows creators to declare the sovereignty of their IP and define usage parameters around their IP.

Gate.io and Tether’s Moves on the Gulf

The Gulf has been one of the leading tech innovation centres of the new millennium, with mega projects like Burj Khalifa in Dubai and Saudi’s “Neom City” key examples.

Fast forward to the current decade, and the region is also leading in terms of blockchain innovation, playing host to some of the major Web3 projects.

Zooming in further, the UAE is spearheading crypto adoption in the region with the country developing virtual asset regulation in both the capital Abu Dhabi and Dubai.

Such are the kinds of developments that continue to attract major crypto companies, with Gate.io’s venture arm Gate Ventures and stablecoin issuer Tether the latest to make a major move.

Gate Ventures and The Blockchain Center in Abu Dhabi Launch $100M Web3 Innovation Fund

The two organisations launched Falcon Gate Ventures, a new venture firm focusing on backing Web3 builders from the USA, Asia, Europe, and the MENA region.

Falcon Ventures will collaborate with global regulators to develop a framework that fosters innovation whilst ensuring user protection.

The venture fund also seeks to build a skilled workforce by investing in education and research initiatives.

Tether Chases an ‘Engulfing’ Crypto Opportunity with Stablecoin Pegged to the UAE’s Dirham

The stablecoin will be launched in collaboration with Phoenix Group and Green Acorn Investment.

Tether CEO Paolo Ardoino sees the move as an attempt to create “optionality towards the US dollar” and thinks the UAE dirham has the potential to become a dominant currency “as global trade shifts.

“We see a lot of interest in holding AED (dirham) outside of the UAE,” he said, citing stability for the country and its currency as potential key drivers of demand.

Web3 AI Startups Get an Innovation Lab

Leveraging blockchain technology to power artificial intelligence applications is seen as a necessity if the industry is to get to the next level.

The decentralised is being used to improve the economic model of the AI industry and address security and user privacy concerns.

Some companies like Fetch.ai have taken on the challenge of developing an open-source decentralised machine learning network where developers can develop new AI agents using its technology.

Others like GenLayer, built by Yeager AI have developed a proof-of-stake algorithm to power applications that interact with real-time information.

Fetch.ai Launches AI Innovation Lab with $10M in Annual Funding

The lab will be based in San Francisco and will support startups developing AI agent technologies using Fetch.ai’s technology.

The lab features a startup accelerator program geared towards transforming startups into industry leaders by leveraging AI.

Fetch.ai is also introducing an Ambassador Innovator Club, an initiative designed to empower ambassadors and innovators to develop new applications using Fetch.ai’s AI agents.

And an Internship Incubator Program designed to accelerate the careers of individuals in high-impact projects.

Web3 AI Startup YeagerAI Secures $7.5M Seed Round Led by North Island Ventures

Other investors in the round include Node Capital, Arrington Capital, ZK Ventures, WAGMI Ventures, BlockBuilders and Maelstrom.

The YeagerAI team has built technology dubbed “intelligent contracts”, blockchain-based systems that leverage LLMs connected to the internet to execute commands.

It enables developers to build apps that can respond to changing situations like the weather and financial markets.

Crypto Fundraising Round-up

Blockchain Capital and 1kx Co-Lead $33M Series A for Fabric Cryptography

The fundraising also attracted participation from Offchain Labs, Polygon and Matter Labs.

The company is building a “Venrifieable Processing Unit” VPU custom silicon chip tailored for cryptography.

Fabric said its VPU is “the first custom silicon chip that uses an instruction set architecture specific to cryptography,” and allows any cryptographic algorithm to be broken down into its mathematical building blocks.

Sorella Labs Secures $7.5M Seed Round to Develop Solutions to MEV Issues on Ethereum

Web3 venture firm Paradigm led the fundraising with participation from Uniswap Ventures, Bankless Ventures, Robot Ventures and Nascent.

The company is building two products, Brontes and Angstrom, with the former debuting on August 20.

Sorella Labs co-founder and CEO LudwigThouvenin described Brontes as an “open-source blockchain analytics tool that processes Ethereum blocks, classifies transaction actions and identifies MEV through pattern matching and analysis.”

SatLayer Secures $8M Pre-Seed Round to Built Bitcoin Retstaking Platform on Babylon

Hack VC and Castle Island Ventures co-led the round with participation from Franklin Templeton, OKX Ventures, Mirana Ventures, Amber Group and Big Brain Holdings.

SatLayer allows users to restake their Bitcoin on platforms like Solv Protocol, Lombard, and Bedrock.

“Many in the space — especially those that have been around for a few years — have substantial bitcoin holdings sitting idle, which can be put to greater use,” SatLayer co-founder Luke Xie said.

On-Chain Analysis

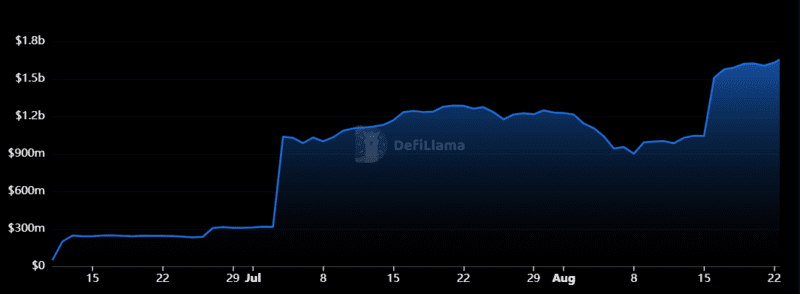

Symbiotic’s TVL Surges 60% In a Week to Hit Record $1.65B

The increase in TVL came shortly after Ether.fi, a liquid restaking platform, announced a strategic partnership with Symbiotic for its next wave of network deployments.

Ether.fi launched on EigenLayer, Symbiotic’s main rival, but it currently supports both restaking platforms.

EigenLayer’s TVL has slightly declined during the last week and has lost 24% over the month.

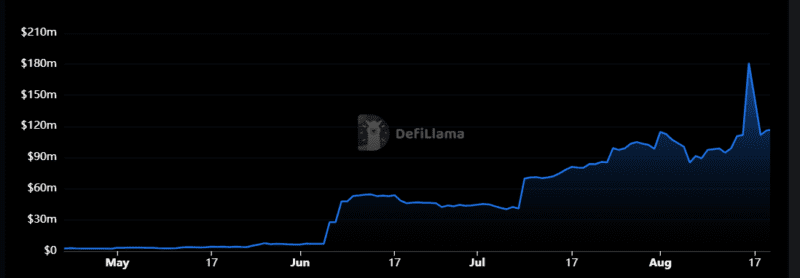

Colend Defies DeFi Market Downturn, Boosts Core Chain to Record TVL

Colend, a lending protocol on Core, saw its TVL surge to $180 million.

No other lending protocol within the top 120 DeFi apps has managed to experience a monthly TVL increase.

At its peak, Colend was the largest dapp on Core by TVL.

Colend’s TVL later corrected to $116 million, becoming Core’s second-largest DeFi app after Pell Network.

Stay on top of things:

Subscribe to our newsletter using this link – we won’t spam!

cool, thanks