Weekly Summary: Focus on Bitcoin Ecosystem as Avalon Labs Hits $1B TVL on BTC Price Rally

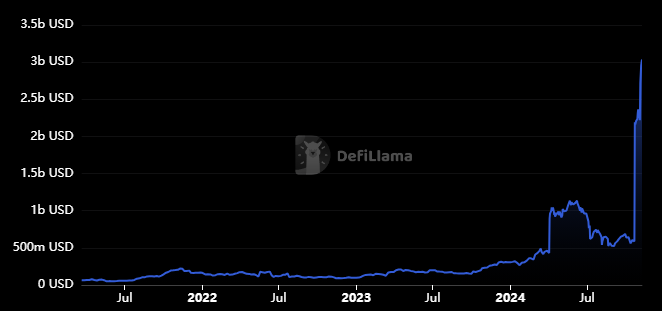

In this edition, Bitcoin price rallied to a new all-time high, driven by Trump’s huge victory, boosting the dollar value of Bitcoin-based DeFi protocols, with the chain's TVL surpassing $3 billion.

💹TVL in Bitcoin Protocols Surpasses $3 Billion

The Bitcoin price this week surged to a new all-time high of about $76,990 thanks primarily to Trump’s victory on Tuesday.

The BTC/USD was already on an upward trajectory throughout October, before making a sharp spike on Wednesday, when Trump became President-elect.

That rally also played a significant role in the rapid increase in the Total Value Locked in Bitcoin protocols. According to DeFiLlama, more than $800 million in value locked has been added to Bitcoin protocols since the start of the month.

The positive sentiment also boosted inflows in crypto ETFs with Spot Bitcoin ETFs experiencing $1.38 billion in daily inflows over the past 24 hours. BlackRock alone accounted for $1.12 billion of the daily inflows on November 7.

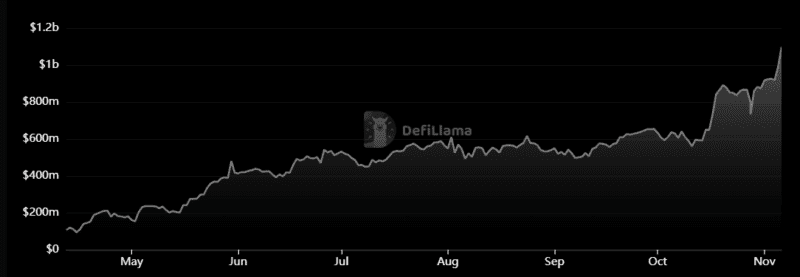

One of the biggest beneficiaries of this week’s BTC rally was DeFi lending protocol Avalon Labs, which acts as a hub for BTC-staked tokens including the Wrapped Bitcoin (wBTC) token, which is the most deposited token on the platform.

Avalon Labs Hits $1B Mark as BTC Price Sets New Record at $75k

DefiLlama data shows that Avalon’s total liquidity value soared by over 25% in the past week to touch $1.1 billion.

The growth has been driven by a slight recovery in token deposits coupled with a significant increase in the Bitcoin price, which gained 5% on November 6.

Avalon Labs has established itself as the liquidity hub for Bitcoin LSDFi, offering several lending and yield products on multiple chains.

Avalon’s flagship DeFi lending platform has nearly $795 million in TVL, up from about $500 million in mid-September.

💵Crypto Fundraising

Vlayer Secures $10M Pre-seed to Build Verifiable Data Infrastructure on Ethereum

The fundraising was completed across two tranches, with the first tranche raising 43 million in February and the second one $7 million in August, The Block reported.

The round attracted participation from a16z Crypto Startup Accelerator (CSX), Credo Ventures and BlockTower Capital.

The company is building “Solid 2.0” a verifiable data infrastructure that introduces new functionality to Ethereum’s programming language.

Some of the new functionalities of Solidity 2.0 include Time Travel — which enables the execution of historical data on-chain and Teleport — which enables smart contracts to run across multiple EVM-compatible networks.

Decentralised AI Startup Pond Secures $7.5M Seed Round Led by Archetype

The fundraising also attracted participation from Cyber Fund, Delphi Ventures, Coinbase Ventures and Near Foundation.

The company plans to use the funds to advance its AI platform including adding DeFi risk management and insider trading detection features.

Pond is developing a platform for building crypto-native AI models for different applications including security, recommendations and DeFi.

Pond co-founder and CTO Bill Shi: “On-chain data is extremely messy and vast in quantity, making it incomprehensible to the human mind. By leveraging AI capabilities, we transform what is beyond human understanding into comprehensible information, helping users make better use of on-chain data.”

🔊More News

Magic Labs and Polygon Launch New Cross-Chain Network Newton

Newton leverages Polygon’s AggLayer to enable developers to build cross-chain dApps that do not require users to keep different wallets.

The new network seeks to solve the problem of balkanization across blockchains.

Newton is part of Magic Labs’ goal of unifying blockchains, creating a system comparable to ACH or SWIFT in traditional finance.

Sean Li, co-founder and CEO of Magic Labs, said in a statement: “Developers can now build user experiences that eliminate barriers. Users should only care about transaction costs and speed, not which chain they are on.”

Jaemin Jin, co-founder and chief product officer at Magic Labs commented: “Magic Labs has always focused on UX first, and with Newton, we’re extending this to solve Layer 2 fragmentation.”

📈On-Chain Analysis

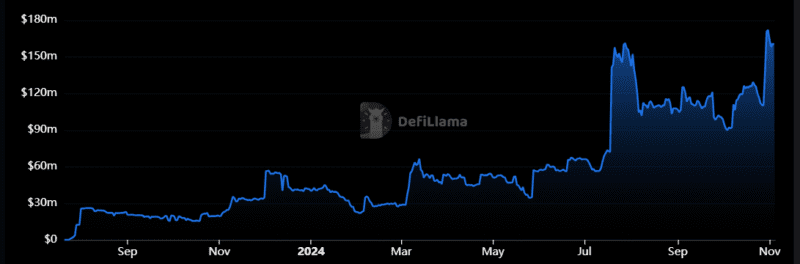

Agni DEX on Mantle Surges to Record $171M TVL Amid cmETH Launch

Agni’s TVL touched the $160 million mark at the end of July but declined until the beginning of October, breaking below $90 million.

The decentralized exchange (DEX) on the Mantle network, recovered at the end of October, and its total value locked (TVL) established a new record high on October 31 at over $171 million.

Both waves of TVL growth are related to the Metamorphosis campaign (through mETH and cmETH tokens).

Stay on top of things:

Subscribe to our newsletter using this link – we won’t spam!